Although most people are familiar with the terms “will” and “trust,” not everyone knows what differentiates the two. Both wills and trusts are useful tools in estate planning. While wills and trusts serve unique purposes, many individuals use them in conjunction to form a comprehensive estate plan. So, what are the functions of a will and a trust, and what are they used for?

What is a will?

A will is a legally enforceable document that dictates how a legal representative will handle your affairs and distribute your assets after your death. Unlike a trust, a will only take effect after your death. Wills are important elements in estate planning, as a will appoints a legal representative to ensure your wishes are followed.

If you’re a parent of minor-aged children, appointing guardianship in your will is imperative. Consider appointing guardianship to a close family member or friend that you entrust to take care of your children. If a will does not appoint guardianship, surviving family members must seek help in probate court to appoint guardianship. Depending on the circumstances, the appointed guardian may not be someone you would have chosen to take care of your children.

It’s also important to consider how you will pass your property to your children. A will places your wishes in the hands of a judge, and your legal representative litigates your estate transfer after your death. A will also give you the power to hand over assets to your chosen beneficiaries.

When creating your will, you can outline how you would like your beneficiaries to use what you have passed on to them. Children—both biological and adopted—have a statutory right to inherit their parent’s assets, but a will gives you the power to disinherit a child. In some circumstances, an individual can also disinherit a spouse. Before disinheriting a child or spouse, be sure to check the laws governing your state.

Legal counsel can significantly facilitate the creation of a will. Although a will becomes effective after your death, there are other drawbacks to consider. For example, your estate becomes a public record after your death, and anything left in your will be subjected to litigation in probate court, which may require costly attorney’s fees.

What is a trust?

A trust involves a fiduciary relationship in which you authorize another party to handle your assets for the benefit of your beneficiaries. Like a will, a trust is another tool used in estate planning. Individuals create trust for various reasons and there are two categories: Living and testamentary. Some individuals choose to use a will to create a testamentary trust, while a living revocable can help surviving family members avoid litigation in probate court.

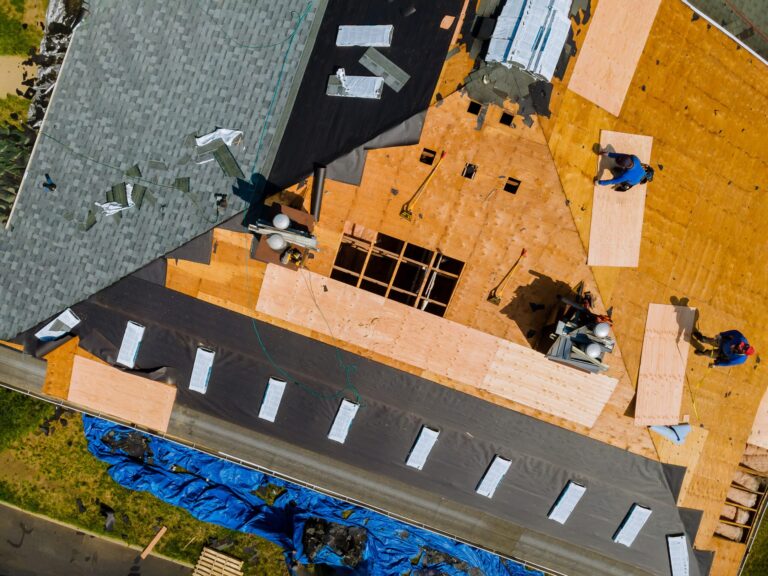

Similar to a will, a trust allows you to transfer property to beneficiaries after your death. A property owner (trustor) creates trust while they are alive. Living trusts are revocable, meaning the trustor can change the trust during their lifetime, and the trustor maintains ownership of the property. After the trustor’s death, the trust takes effect.

Unlike wills, trusts do not require litigation in probate court. Trustors can use trusts to immediately pass property or assets to beneficiaries after their death. For many individuals, trusts are more affordable. An individual known as the trustee is named in a trust to control the distribution of the trustor’s assets.

Whether you create a will or trust, seeking legal counsel and the help of a professional estate planning company is crucial. While trusts offer control of assets outside of probate court, they must be actively managed throughout the trustor’s life. Ultimately, making your estate plan a priority now can greatly benefit your surviving family members after your death.