Holding a life insurance policy is a good idea, regardless of whether you’re young and healthy or a senior who is enjoying their golden years. Life insurance is defined as its name suggests—a policy that provides insurance that you and your family members (or other beneficiaries) are well taken care of, regardless of what happens in your life. While mortality is never a comfortable subject, it’s a crucial conversation topic to address, nevertheless. Whether we like it or not, we will all pass on. When that happens, you’ll want your beneficiaries to be cared for.

With that in mind, it’s also important to recognize that there could be moments in which it makes sense to sell off your life insurance policy to a third party. Sometimes, life throws us a curveball and we find ourselves unable to pay for medical bills, home repair costs, or a large accumulation of debt. At these moments, it’s good to know that there are options that allow you to sell a life insurance policy in return for a lump sum upfront. Read on to learn about these options and how they might come in handy.

Viatical Settlements

If you have never heard the term “viatical settlement” before, don’t be alarmed. The truth is that viatical settlements are still uncommon financial options, despite the fact that they offer a life insurance policyholder a great option when it comes to extreme measures. A viatical settlement is useful if a policyholder is diagnosed with a terminal or chronic illness and, therefore, a shorter life expectancy.

First, when the policyholder sells their life insurance policy to a third party, they get an immediate payout. This money is less than the death benefit would be but still more than the cash value of the insurance policy that the insurance company would have paid for a buyout. Second, this money is not taxed, which means that you get the full sum. Depending on inheritance tax laws in the state you call home, this may not be true for the beneficiaries who would be receiving the death benefit upon the policyholder’s passing. Third, and most crucial, there is no limit to what a policyholder can spend the money from their viatical settlement on.

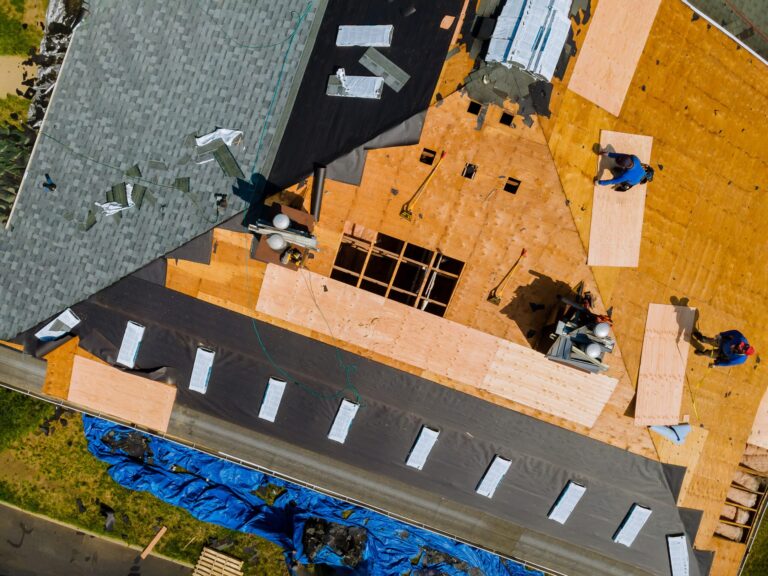

Did you neglect the budgeting for regular home maintenance, and now have major leaks and need for a new roof or gutter repairs? You can use the money to cover those repair costs. Need to pay for hospice care or medical treatments? You can use the money for that as well. Once you’re done with the paperwork for a viatical settlement, you can use your accelerated death benefit for everything from hiring a contractor to install a new furnace or water heater, to heading to Hawaii for a vacation that ticks off all your bucket-list items.

Life Settlements

Life settlements are very often confused with viatical settlements. Though they share many characteristics, there are also crucial differences to take note of. For one, you don’t have to have a terminal or chronic illness to opt for a life settlement, and the money you’ll get is not dependent on your life expectancy. Another major difference that the cash you receive from a life settlement might be taxable (depending on the state laws of where you live and the details of your life insurance policy), whereas a viatical settlement is free of tax requirements. Thirdly, the sum of money you receive for a life settlement is usually less than the amount you would receive through a viatical settlement. Viators or brokers who specialize in the intricacies of life settlements and viatical settlements will be able to explain the differences and similarities in more detail. This is why the best way to explore your viatical settlement options is to get in touch with a viatical settlement provider and ask any questions that you have on your mind. These financial advisors will be able to give you the peace of mind you’re looking for and help you manage your finances with ease.

Whether you’re looking to take care of major repairs on your home, revamp your HVAC system, or spend the cash value of your life insurance policy on getting to the bottom of your bucket list, these are two options that might be the way to go for policyholders. Get in touch with a Viator or a broker to discuss your options and make an informed decision so that you have enough money to face anything that comes your way.