No one wants to imagine themselves in a dire financial situation. However, despite our best preparations, sometimes events beyond our control force us to make difficult choices about how to manage our finances. In some cases, this can include considering the benefits and drawbacks of filing for bankruptcy. As a homeowner, you should be proactive about being in good financial health prior to purchasing your home, but financial situations can change rapidly and unexpectedly. If you own your home or you’re considering buying one in the near future, read on to learn about what happens when you file for bankruptcy as a homeowner.

What financial services should you consider for your home?

The first financial service you’re likely to need on your journey toward homeownership is a mortgage. It’s important to set a firm budget before you start looking for a home after determining how much money you can afford to put down and what type of monthly payment you can realistically afford. Finding the right mortgage can take time, and you should always ask for a quote from multiple borrowers to ensure you’re getting the best interest rate available.

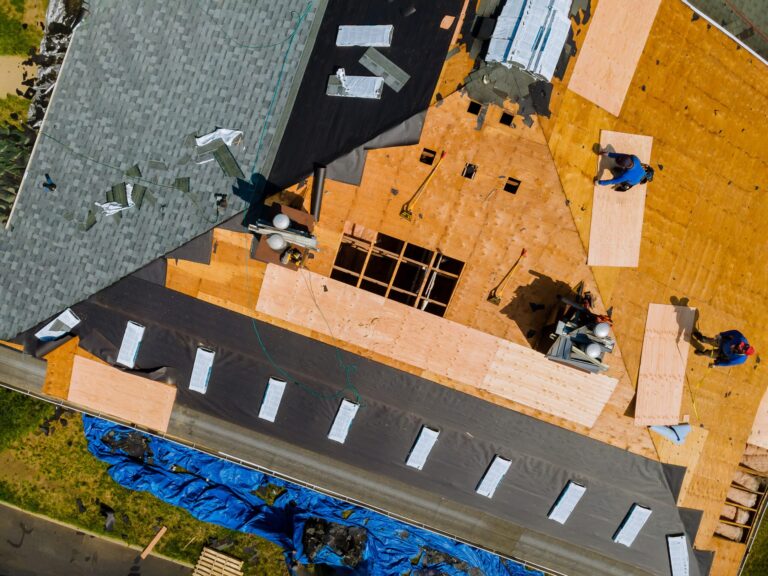

A home warranty can also be a smart investment for you and your family, especially if you live somewhere prone to extreme weather events. If you’re unsure what a home warranty is, it’s a policy that provides for the repair and replacement of appliances and systems in your home in the event of breakdown or malfunction. Texas is a great example of a state that can deal with serious challenges due to the heat in the summer and can fall victim to hurricane season from time to time, too. If you own property in the Lone Star State, it may be a good idea to look for a high-quality home warranty in Texas.

What happens if you need to file for bankruptcy?

Before going any further, it’s important that you understand what exactly bankruptcy is. Bankruptcy is a legal process by which an individual or an entity that cannot afford to repay debt can discharge some or all of the debt. Since filing for bankruptcy is a legal process, it is carried out through a court order, which is typically filled by the person or entity that is responsible for the debt.

Whether or not you can keep your home after filing for bankruptcy depends on a couple different factors. These include which chapter of bankruptcy you file, how much of your mortgage you’ve paid off, and whether or not you will be able to afford to make your monthly payments while dealing with your debt. Chapter 13 bankruptcy is more flexible, but even Chapter 7 filers have the opportunity to keep their residence in some circumstances.

If you do choose to file for bankruptcy, make sure you have the expert help you need. Look for a quality attorney with a website that fully details their experience and the services they offer, like this bankruptcy attorney in Birmingham. Your attorney can explain the differences between Chapter 7, Chapter 11, and Chapter 13 bankruptcy and help you determine which solution makes the most sense for you.

Homeownership is an incredible milestone and a goal that you should spend a significant amount of time preparing for. There are a number of services, from a mortgage to a home warranty, that can help you manage your money as a homeowner. However, even the most prepared families may experience a sudden change in their fiscal circumstances. That can necessitate difficult decisions, like whether or not to file for bankruptcy. Choosing to file for bankruptcy is a serious decision and should always be a last resort, but there are some situations where you may be able to hold on to your home and mortgage despite your declaration of bankruptcy if you know how to approach the process.